|

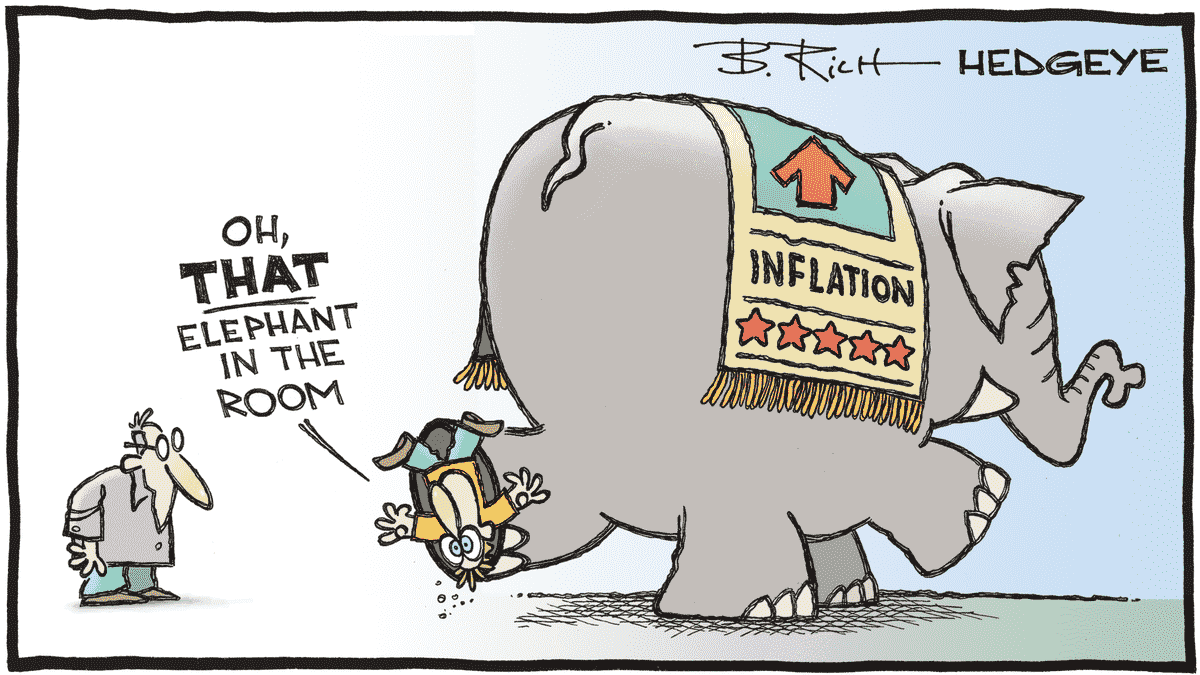

| Courtesy image selected by PillartoPost.org via Internet. |

GUEST BLOG / By Angelo Kourkafas, CFA Investment Strategist, Edward Jones Co.

Editor’s Note: As Edward Jones is the financial advisor of this daily online publication, permission has been granted to pillartopost.org to republish certain data to our readership.

Prices Are High - What's Priced In?*

The bumpy ride for financial markets in the early days of 2022 continued last week, with inflation remaining front and center. A multidecade jump in consumer prices was a reminder that inflation is a key driver and risk for the year ahead, impacting Federal Reserve (Fed) policy, consumer spending, bond yields and sector leadership. With prices high, yields rising, and valuation concerns, we examine what's expected and likely priced in by the markets, along with implications for portfolio positioning.

Price pressures continue to build but are possibly peaking in the coming months

All eyes were justifiably on inflation last week, with the released data revealing the fastest price increases in decades.

The consumer price index (CPI) rose 7% in December from a year ago, the fastest pace since 1982 and the eighth straight month in which inflation exceeded 5%. Excluding the volatile categories of food and energy, inflation rose 5.5%, the most since 1991.

Like last year, goods inflation played a large part in the jump in prices. For example, prices of used cars and trucks soared 37%, and furniture prices rose 14% from a year ago. While pandemic-related supply-and-demand imbalances continue to drive prices for durable goods higher, services inflation is also strengthening but to a lesser extent, rising 3.7% in December.

As supply chains normalize, energy prices level off, and year-ago comparisons become tougher, we expect inflation pressures to peak in the coming months and start moderating more meaningfully in the second half of the year. However, uncertainty around the timing is high because the omicron variant is worsening the labor and material shortages, at least temporarily.

Even with prices for goods likely cooling off once bottlenecks begin to ease, services inflation is likely to stay strong, supported by home-price and rent increases and rising wages, which is why we expect overall inflation to stay above the Fed’s 2% target through 2022.

What's priced in?*

While eye-popping, the December consumer price gains were no worse than feared and, likely because of that, stocks rose and bond yields fell the day of the release. After having been surprised by the upside for most of the past year, the CPI has now been in line with consensus expectations for two months in a row. There are certainly upside inflation risks, but because investors have already recalibrated their expectations higher, we think that markets can stay resilient in the face of high prices in the near term.

Curbing inflation is now a priority for the Fed In the first two weeks of this year the Fed has made another hawkish pivot, with policy now clearly shifting to combat inflation. Fearing that price pressures might become entrenched; a number of Fed officials are now calling for policy rates to rise as early as March.

As a reminder, it was not that long ago (March 2021 meeting) that policymakers were projecting no interest-rate hikes through 2023. In our view, last week's inflation reading, together with the recent drop in the unemployment rate below 4%, solidify expectations for an earlier start to interest-rate hikes.

The upcoming start to the Fed's tightening cycle, the sixth over the last 40 years, is a milestone that reflects not only the unexpected inflation overshoot but also the strength of the economic expansion and labor market.

The pivot from emergency support to dialing back the accommodation, then to tightening, is another datapoint signaling that the cycle is progressing further into the midcycle phase. Equity markets might no longer be in the highly rewarding early-expansion phase, but they are not in the late-cycle phase either, in our view.

What's priced in? Bond markets are currently pricing in about a 90% probability that the Fed hikes rates four times this year, up from just one hike expected in early October. While it is possible, we think that it will be hard for the Fed to tighten more aggressively than what the market is currently pricing in.

Possibly, the retreat in the 10-year yield from 1.80% to 1.75% after mid-January's inflation data confirms that a lot of the Fed repricing has already happened.

Rising bond yields challenge lofty valuations.

Earnings to the rescue? After three back-to-back years of above-average returns, stock valuations are high relative to their own history. The speed at which bond yields have climbed in response to higher inflation and shifting Fed policy has forced investors to rethink their portfolio allocations.

One of the most notable recent developments is the rotation away from pricey growth-style investments towards the more reasonably priced value investments. Because technology stocks carry outsized weight in major indexes, valuation concerns have triggered a pullback in U.S. large-cap stocks.

On a positive note, the valuation gap between equities and bonds remain fairly wide, continuing to support equities and reinforcing the "TINA mantra" (There Is No Alternative to stocks) for now. Even though yields are on the rise, they remain low. And as long as corporate earnings rise at a decent pace, the relative valuation gap can be sustained.

What’s priced in? Banks kicked off the earnings season last week. Results were generally solid, but the bar was high following the group's outperformance in recent weeks, and the sector pulled back. S&P 500 earnings are forecast to increase 21% in the fourth quarter, marking the fourth straight quarter of earnings growth above 20%.

For 2022, consensus expectations are for earnings growth to decelerate but still grow a healthy 9%1. We expect valuations to slightly decline, consistent with the historical experience during past Fed-tightening cycles. However, the current earnings estimates appear reasonable to us, with potential for upside if above-trend economic growth materializes as projected.

The investment puzzle: Putting the pieces together

Slowing but still robust economic growth, high inflation, and upcoming rate hikes complicate the investment landscape for the year ahead. We think that this backdrop translates into lower returns and more volatility, but still a continuation of the bull market.

Even if the Fed hikes rates four times as priced in, we think that policy will be far from restrictive. A policy rate near 1% by year-end would be well below the 5.5% - 6.5% expected nominal GDP growth (3% - 4% after inflation), below the Fed's 2.7% inflation forecast for 2022, and below the pre-pandemic policy rate.

Stocks have historically experienced some volatility around the first interest-rate hike but generally maintained their upward trajectory six months and a year out. While returns tend to moderate after tightening begins, equities haven't historically run into trouble until the tail end of the cycle when the yield curve inverts. Given our view that the upcoming 2022 Fed hikes won't choke off the economy, we would view any Fed-induced pullbacks or corrections as an opportunity to add quality investments at lower prices

ABOUT THE AUTHOR--Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, Fortune magazine, Marketwatch, US News & World Report, The Observer and the Financial Post. Angelo graduated magna cum laude with a bachelor's degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

|

| Angelo Kourkafas |

*DEFINITION: Priced-in means that the current or upcoming news event / economic release is already reflected in the current prices.

No comments:

Post a Comment